Excitement About Paul B Insurance Medicare Insurance Program Huntington

Wiki Article

About Paul B Insurance Medicare Supplement Agent Huntington

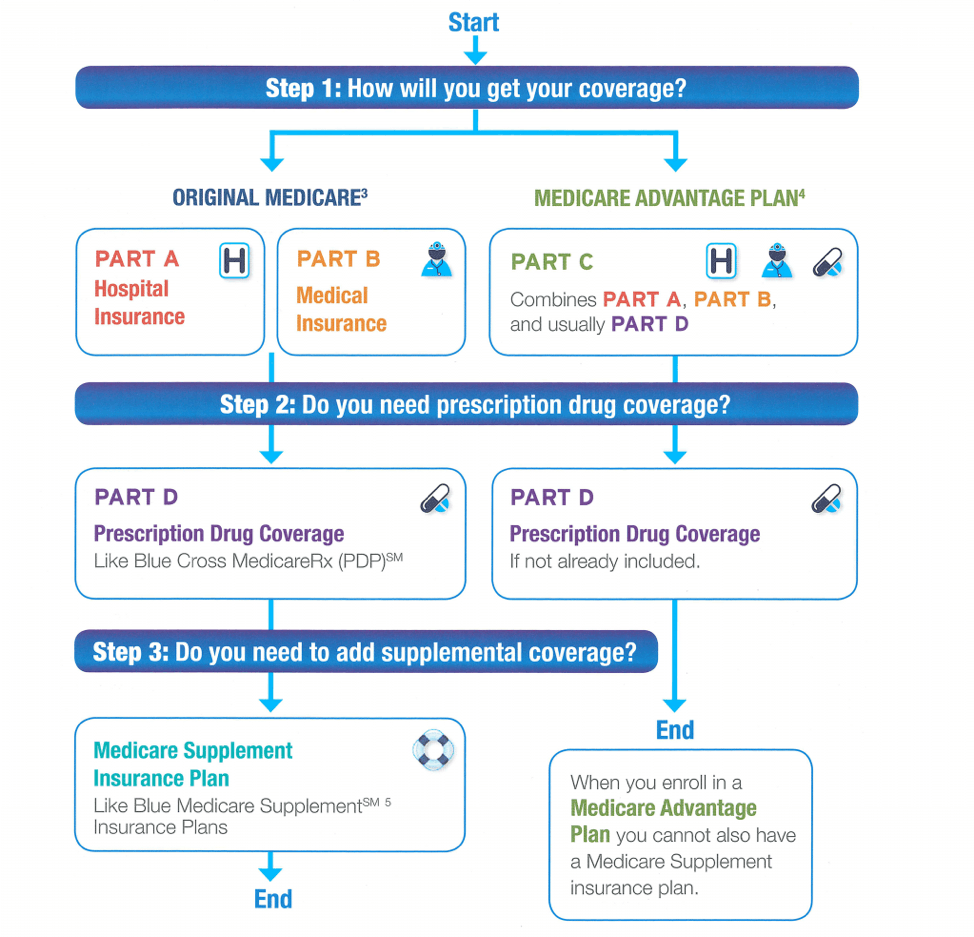

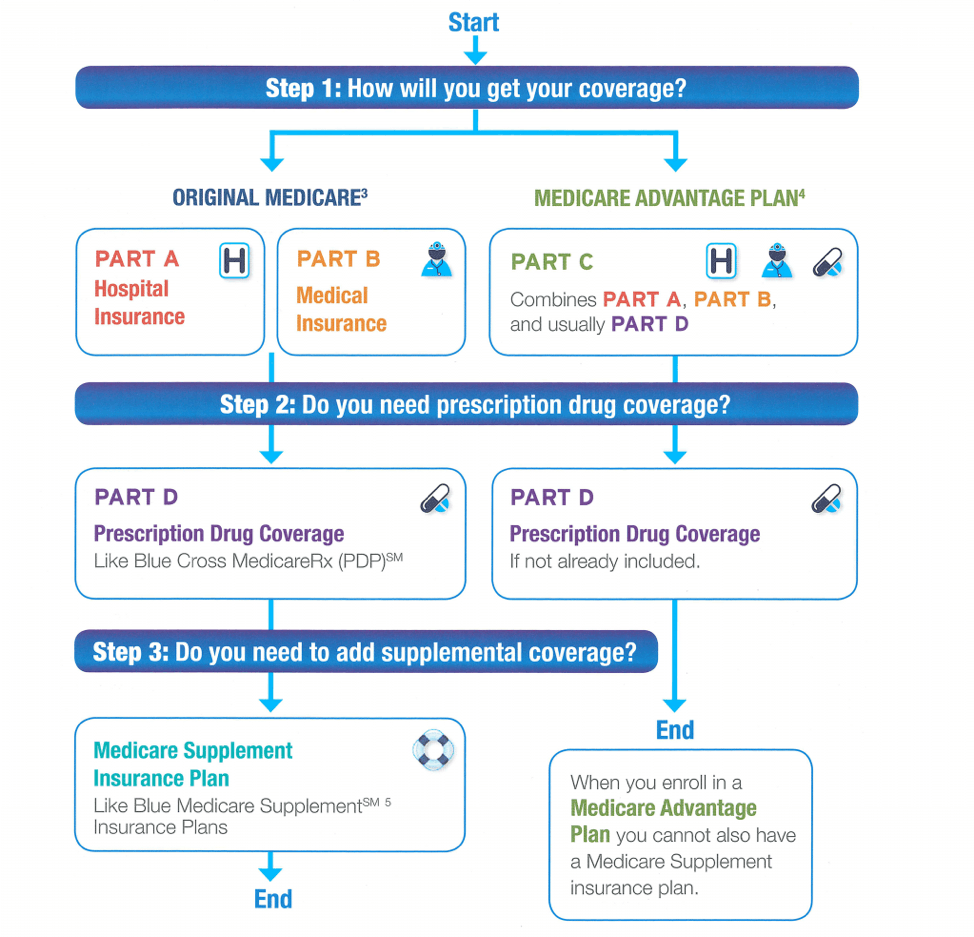

A: Original Medicare, also understood as traditional Medicare, includes Part An as well as Part B. It enables beneficiaries to visit any kind of physician or healthcare facility that accepts Medicare, throughout the USA. Medicare will pay its share of the charge for each solution it covers. You pay the rest, unless you have extra insurance coverage that covers those prices.

Trying to decide which kind of Medicare plan is ideal for you? We're here to assist. Discover more about the various parts of Medicare and kinds of healthcare strategies offered to you, consisting of HMO, PPO, SNP strategies and also more.

Typically, the various components of Medicare help cover certain solutions.

It is sometimes called Typical Medicare or Fee-for-Service (FFS) Medicare. Under Initial Medicare, the government pays directly for the wellness treatment solutions you get.

What Does Paul B Insurance Medicare Advantage Agent Huntington Do?

It is very important to understand your Medicare protection options and to select your protection thoroughly. Exactly how you choose to obtain your benefits and that you obtain them from can affect your out-of-pocket expenses as well as where you can obtain your care. For instance, in Original Medicare, you are covered to go to almost all doctors and medical facilities in the nation.

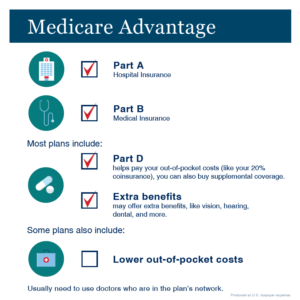

Nonetheless, Medicare Advantage Program can additionally supply fringe benefits that Original Medicare does not cover, such as regular vision or dental treatment.

Formularies can vary by plan, and also they may not all cover your required drugs. For this factor, it is necessary to assess available coverages when contrasting Medicare Component D prepares.

Before you enlist in a Medicare Benefit plan it is necessary to understand the following: Do all of your service providers (physicians, hospitals, and so on) accept the plan? You should have both Medicare Components An and B as well as live in the service location for the strategy. You must remain in the plan till the end of the fiscal year (there are a few exceptions to this).

Paul B Insurance Medicare Advantage Agent Huntington Things To Know Before You Buy

Most Medicare drug strategies have a coverage void, also called the "donut opening." This suggests that after people with Medicare, called beneficiaries, and also their strategies have invested a particular amount of money for covered medicines, the beneficiary might have to pay higher prices out-of-pocket for prescription medicines. The insurance coverage space is one phase of the Medicare Part D prescription medicine coverage cycle.

Understanding regarding Medicare can be an overwhelming task. Yet it does not have to be. HAP is here, helping you understand the fundamentals of Medicare (Parts A, B, C and also D), the 3 primary kinds of Medicare (Original, Medicare Benefit, and Supplemental), and also the registration timeline right from signing to switching when a strategy doesn't meet your demands.

People with Medicare have the choice of obtaining their Medicare benefits with the traditional Medicare program carried out by the federal government or via a personal Medicare Benefit plan, such as an HMO or PPO. In Medicare Advantage, the federal government contracts with personal insurance providers to provide Medicare benefits to enrollees.

The discount has boosted considerably in the last several years, greater than increasing because 2018. Nearly all Medicare Advantage enrollees (99%) are in plans that call for previous consent for some services, which is normally not made use of in standard Medicare. Medicare Benefit strategies also have defined networks of suppliers, in comparison to traditional Medicare.

Some Known Facts About Paul B Insurance Medicare Agent Huntington.

Completely, consisting of those that do not pay a costs, the average enrollment-weighted costs in 2023 is $15 each month, and also averages $10 monthly for just the Part D section of protected advantages, substantially less than the average costs of $40 for stand-alone prescription medication plan (PDP) costs in 2023.

As plan bids have actually decreased, the discount portion of plan repayments has boosted, as well as plans are assigning several of those rebate bucks to lower the component D section of the MA-PD premium. This fad adds to higher availability of zero-premium plans, which reduces average costs. Considering that 2011, federal law has actually required Medicare Advantage plans to supply an out-of-pocket limit for solutions covered under Parts An as well as B.

Whether a plan has only an in-network cap or a cap for in- and also out-of-network services depends on the kind of plan. HMOs usually just cover solutions given by in-network providers, whereas PPOs likewise cover services provided by out-of-network suppliers yet cost enrollees greater price sharing for this treatment. The size of Medicare Advantage service provider networks for doctors and also healthcare facilities vary considerably both across counties and across strategies in the same county.

Rumored Buzz on Paul B Insurance Medicare Agent Huntington

For instance, paul b insurance local medicare agent huntington a dental benefit may include precautionary services just, such as cleansings or x-rays, or even more detailed coverage, such as crowns or dentures. Plans likewise vary in terms of expense sharing for various solutions as well as limits on the number of services covered each year, numerous enforce a yearly buck cap on the amount the strategy will certainly pay toward covered solution, as well as some have networks of dental carriers beneficiaries need to choose from.

As of 2020, Medicare Advantage plans have actually been permitted to consist of telehealth benefits as component of the fundamental Medicare Component An as well as B advantage plan past what was enabled under typical Medicare prior to the public health and wellness emergency situation. These benefits are thought about "telehealth" in the figure above, despite the fact that their expense might not be covered by either discounts or additional premiums.

Prior consent is likewise required for the majority of enrollees for some additional benefits (in strategies that offer these advantages), including extensive dental solutions, hearing as well as eye exams, as well as transportation. The variety of enrollees in plans that require previous consent for one or more solutions stayed around the same from 2022 to 2023.

Report this wiki page